I have sold a property at 113 555 FOSTER AVE in Coquitlam

The upside of downsizing

Hey, downsizer - the only thing you have to fear is fear itself.

Chances are, if you're reading this, you've at least thought about it. Most boomers do at some point, and a lot of us follow through on it.

The Conference Board of Canada has predicted more than 80 per cent of new housing demand will come from those over 65 in the next 20 years.

Those number geeks also say 60 per cent of new households will be formed by those 75 and up.

That's a lot of tears and moving boxes, people.

My wife and I missed the Freedom 55 moment two years ago, but after a dizzying flurry of real estate transactions, basement purging and a jump off some emotional and financial cliffs, we're living the next best thing: the downsizer dream. The following advice is worth what you've paid.

DON'T THINK IT THROUGH

Carefully researching neighbourhoods, analyzing the market, selling before you buy - you'll never do it.

The very thought of dealing with all your stuff is enough to make you open another bottle of wine and watch Hoarders instead. See, those people are much worse than you. Besides, you love your house.

Our household was split along pretty familiar gender lines for ages. I regularly issued orders that we were moving downtown to end my three-hour daily commute and painful war with the flora and fauna in our yard. My wife, meanwhile, continued to transform said yard into a garden paradise and nurture our social connections in a beautiful beach neighbourhood.

It all came to a crashing halt after 18 years when my wife did the unthinkable: she called my bluff and fell in love with a 686-square-foot apartment on Stanley Park. The loss of a beloved family pet really started it all (a familiar story, it turns out), but before I could get out the words "uh, maybe we should think about this," the apartment was purchased and the house had to go.

Fasten your seat belts; it's time to sell the house.

FIRST RULE - DO NOT TAKE IT PERSONALLY

After almost 20 years at the same address in a community we loved and a house that we had gutted once and renovated almost constantly, we were thrust into a harsh new world of real estate bargaining - and a closing date on the apartment loomed.

We soon learned it's a jungle out there, and the market was on the verge of softening.

The process was brutal, as personal items and artwork were appraised and became part of the purchase-offer battleground.

Just to make it a little more interesting, one of our best friends became our realtor. The result? Sold in eight days, and we had to be out in three weeks.

Needless to say, we're all still the best of buddies.

NOW COMES THE HARD PART. YOU HAVE TO GET RID OF YOUR STUFF

Chances are, one spouse will do more of that work than the other. And that there could be some temptation on the other's part to critique that work.

That could lead to different interpretations of what is "good stuff" and what is not. Tread softly, and for the love of Santa, do not ask if the family really needs four boxes of Christmas stuff (when the count has already been whittled in half.)

"Good stuff," when it came to classified ads and garage sales, turned out in our case to be the kitsch and mid-century modern. Beautiful heirloom furniture from mom and dad? No thanks, but I'll take that cool Coke sign or funky night light. If it was big, and made robustly out of wood to last the ages, nobody wanted it. That included a heritage baby grand piano. But if it was in any way featured on TV in the '60s or '70s, it was gone.

We dreaded dealing with the almost 40 years worth of photo albums, but my wife dealt a master stroke. Photos were ripped from the pages and compiled according to the faces in the snapshot. Each family member and old friend then received a package of nostalgia to do with what he or she saw fit.

After the giveaways to family members and friends, the sales to those who responded to ads and the parade of antique dealers who toured the house, it was time to face the music.

If there's anything worse than waking up at 6 a.m. with a massive hangover, it's waking up at that ungodly hour to put on a garage sale. In the rain. At least you get to see who your real friends are.

After the soggy but successful garage sale (due entirely to the efforts of my wife and our friend/realtor), and a subsequent visit by the thrift-store truck, the rest went into landfill.

Probably the only really sad part of the whole thing.

MOVING DAZE

Did I mention the apartment hadn't been updated in 40 years and was to undergo a complete renovation? Hello hotel room for 10 weeks. One offshoot of this encampment was an unhealthy attraction we acquired to the "reality" TV show Storage Wars. It could have been due to the downtime we suddenly had, or by the fact that we had to rent one of those lockers (10 by 20 ... nice unit) to hold the 21 boxes and other "good stuff" until the apartment was livable. Every night, I was visited by a nightmare that featured a diamond saw cutting the lock off our locker to the "oohs" of a frenzied group of bargain hunters with eyes all over my guitar cases and amps.

Going multi-family after 30 years of house living comes with a whole new set of rules governing elevator use, noise levels and parking/bike storage space. Even though there's less of almost everything, it seems to take longer to get anything done. And you can forget about taking shortcuts. Even though excellent movers handled the job, the whole process left us exhausted ... and the torn shoulder muscles have yet to heal.

DOWNSIDE, UPSIDE ON DOWNSIZING

Can't say we've really found a downside. We do miss friends from the old hood, but great neighbours and merchants are certainly found in our new stomping grounds.

The beloved garden has been traded for a small balcony space, the baby grand piano for an upright. Friends and relatives from afar still visit us, they just overnight in funky nearby hotels instead of the spare bedroom we no longer have.

The biggest plus is probably an end to reliance on the car. Walking to work, shopping, concerts, sports events and pretty much anything else keeps us healthier and happier - not to mention making everything much more affordable. As near gridlock approaches on the rush hour and with transit funding, it's hard not to feel smug about being part of the solution after years of causing the problem.

This kind of radical downsizing may not be for everyone - those who want space for visiting children and grandchildren come to mind - but we've found it completely liberating. (After the reno was completed, we were surprised with how the apartment resembles an upscale version of the one we moved into after we got married.)

A fresh start is fun - the hardest part is taking the first step out the door!

What you need to know about Underground Oil Tanks!!

Many homes in the Greater Vancouver area built before 1957 were originally heated with furnace oil. When natural gas became available, the oil storage tanks, which were normally located underground in backyards, were filled with sand or capped.

However, as these unused buried oil tanks start to corrode and rust, the remaining oil can leak out and flow onto the rest of the owner's property, the neighbour's property, storm sumps and waterways, resulting in contamination of soil and water. Apart from the negative financial impact on the market value of the property, the owner can face substantial legal liability under various statutes and bylaws for such contamination. The BC Fire Code and bylaws of twelve municipalities (including the City of Vancouver) all essentially require that out-of-service underground oil storage tanks (USTs) be removed and that all contaminated soil must be removed and replaced with clean fill.

The BC Fire Code and bylaws of twelve municipalities (including the City of Vancouver) all essentially require that out-of-service underground oil storage tanks (USTs) be removed and that all contaminated soil must be removed and replaced with clean fill.

Exceptions

A very limited exception may be granted by the fire authority where the removal of the UST is impractical because it is located under a permanent structure or its removal would endanger the structural integrity of nearby buildings.

In that case, the owner would still have to render the UST "inert" in accordance with "good engineering practices." That would include arranging, at their own expense, for the remaining oil to be pumped out, for the tank to be filled with sand and all piping to be capped, as well as arranging for the removal of contaminated soil and replacing it with clean fill.

In addition, written verification of such work must be provided by a licensed contractor to the fire authority.

Responsibility for Removal

The responsibility for the removal of the UST and remediation of any contamination falls on the current property owner.

The costs of such removal can be high depending on how much remediation work is involved. However, if the UST is ignored and not dealt with promptly and correctly, the costs can be exponentially more.

In one case that was reported in 2008, an owner of a West Vancouver home, who bought the home in 2000 not apparently aware that there was a buried oil tank, had to spend close to $160,000 to remove 5,000 liters of contaminated fuel from a leaky home-heating oil tank that had not been used in 25 years!

Such cases are rare, but it does highlight the need to conduct due diligence when buying a home that may have an unused underground oil tank.

Contamination

In addition to the BC Fire Code and municipal by-law requirements, the owner may also be subject to the Environmental Management Act of BC if the concentration of the contaminants present in the soil or groundwater exceeds the allowable limits prescribed for residential properties and therefore meets the definition of a "contaminated site."

In that event, the owner can be ordered to undertake remediation of the property and neighbouring properties if the contamination has spread. It may be possible for the owner to recover some of the costs incurred from more culpable previous owners through a "cost recovery action" pursuant to the Environmental Management Act, but only if they can be found and have the resources to pay.

An owner or former owner may also be found liable under commonlaw nuisance for failing to take steps to prevent seepage of oil to neighbouring properties.

Seller's Obligations

The seller normally will provide a prospective buyer with the Property Disclosure Statement ("PDS") that requires disclosure of a number of potential defects, including the presence of an underground oil tank. If the seller declares that the property does not to their knowledge contain an UST and/or is not contaminated, which later proves incorrect, the seller can be liable for negligent misstatement.

Moreover, if the PDS is expressly stated to form part of the contract and there is an unqualified statement that there is no UST, then this becomes an actual warranty, so that if a buried oil tank is discovered on the property the seller will be liable for breach of contract.

Similarly, if the seller states expressly in the contract that there is no contamination at the property, the seller will be contractually liable to the buyer if contamination is discovered. As well, the courts have held that sellers have a duty to disclose a latent defect that could be dangerous or a hazard to human health, and failure to do so may well make them liable to the buyer for damages sustained as a result of their failure to warn.

In summary, if there is an UST, then the seller should be advised to disclose this fact to the buyer and ensure their representations are accurate. The seller can then go ahead and arrange for a qualified tank removal contractor to remove the UST and clean up any oil contamination in accordance with all permits and applicable statutes, bylaws and the BC Fire Code, and provide sufficient written proof to the buyer prior to completion.

Alternatively, if the seller does not have the money to do this, they could try to negotiate a price reduction in exchange for a release and indemnity from the buyer with respect to the UST and remediation of any contamination. However, the seller can still remain liable under the EMA and the buyer may not be able to agree to this because of the requirements of their insurer and lender, who will want the UST and any resultant contamination issues dealt with prior to completion before funds are committed.

What Can Buyers Do to Protect Themselves?

If there is a suspicion that there may be an UST and the seller will not or can not confirm either way, the buyer should be advised to make the offer subject to a satisfactory inspection that satisfies the buyer there is no buried oil tank and that the property is not a contaminated site.

It would be prudent to engage the services of a specialized UST inspector to conduct a magnetic survey to detect an UST and then, if located, the integrity of the tank can be examined and surrounding soil can be checked for the presence of contaminants.

The buyer should also put in another condition precedent into the contract that if there is an UST, the offer is subject to the seller arranging, at their own expense, for the UST to be drained and removed and for the soil and groundwater to be assessed for contamination and, if contaminated, the seller will ensure the soil and groundwater is fully remediated in compliance with all applicable statute, bylaw and BC Fire Code requirements.

The contract should also provide that it is a fundamental term of the contract that all the work will be done by a qualified tank removal contractor and that the seller shall provide to the buyer on or before the completion date all necessary written certificates and reports from the tank removal contractor and the fire authority that all work was completed in compliance with the applicable statutes, bylaws and BC Fire Code.

A buyer should be strongly advised, even in the face of competing offers for a property, to not remove any conditions without the UST and remediation work having been completed properly by the seller. Similarly, the buyer should not agree to take on the responsibility of the removal of the UST and the remediation of any contamination in exchange for a price reduction without fully realizing the potential liability that would ensue upon becoming the new owner.

Insurance Issues

As insurance companies are worried about the potential impact and expense of any environmental contamination caused by a leaking corroded oil tank, it is very hard to obtain home insurance for homes which have an exterior oil tank older than 15 years. Even if home insurance is obtained, there will undoubtedly be a leakage/pollution exclusion which would make the property owner bear the full costs of such an event. Another scenario may be that as a condition of providing insurance the owner must remove the oil tank within 30 days of the policy being issued, which again will result in a big cost for the owner to pay.

Also, an owner will not be able to obtain financial protection from a residential title insurance policy as the policy will have exclusion for any environmental damage, including that caused by a leaking oil tank, even if the owner had no idea the oil tank was there.

Financing Issues

For residential transactions concerning a known UST, the lender will normally insist, before approving any funding commitment, that the buried oil tank be removed in accordance with the applicable statutes, bylaws and BC Fire Code and for the soil to be tested for contamination and remediated as necessary.

In such a situation, a prospective buyer should not remove any financing condition until they receive written confirmation that the lender has approved of the UST removal and remediation process, is satisfied with all required reports issued by the tank removal contractor and is still prepared to provide mortgage financing for the purchase.

Underground Oil Tank Removal Process

Property owners should always hire an experienced and qualified contractor in oil tank removal. If an underground oil tank is found and has to be removed, then, upon obtaining a tank removal permit from the applicable municipal fire authority.

- The remaining oil has to be pumped out and taken to an approved recycling/disposal facility;

- The UST must be removed;

- The soil must be assessed for contamination. If contamination is present, soil and groundwater must be properly remediated, which may include complete removal; and

- The property owner must obtain a report, and photos, from the tank removal company, detailing the removal process, what was pumped out of the UST, a receipt from the facility where the UST was taken to and the amount of soil brought in. The report should confirm that the UST was removed in accordance with all applicable statutes, bylaws and the BC Fire Code and, in the event of contamination, that the soil and groundwater have been remediated in accordance with the standards prescribed in the EMA and further testing is not necessary. This report can then be provided to prospective buyers in the future as evidence that the UST has been dealt with.

Source: REW.ca

New property listed in Coquitlam West, Coquitlam

Let's see what is Scott McGillivray’s Tips on Winning a Bidding War

With over a decade of investing in real estate under my belt, I’ve learned a few things about the buying and bidding process. Whether you are a first time buyer, looking for a bigger home, or downsizing, investing in real estate is a smart decision – but only if you do it wisely. Bidding wars, unfortunately, may be here to stay, so here’s some advice that may help you to secure your next property.

- Crunch the Numbers

One of the most important elements in the process of buying a home, particularly if you enter a bidding war, is getting pre-approved by your bank or mortgage company so you know exactly what you can carry - and how high you can go in your offer. - Do your Homework

Buying a property is the most expensive financial decision most people will ever make in their lifetime so spending time to research the neighbourhood is so critical. There is so much emphasis on house inspections, and there should be, but the same amount of care should also be spent checking out local schools, transportation links, parks, crime rates, medical offices, family activities, seniors programs, daycares and even future housing developments. - Nail the Timing

I try to get into properties on a Wednesday so I can put in an offer on Thursday and avoid the weekend open house competition - or before they are on MLS. By beating out the weekend competition, I might not have to enter into a bidding war. There’s no law that states that you can’t make an offer before the official offer date and a good agent should send you properties as soon as they are available and preferably before they go public. - Pick the Right Agent

Having an agent who has your best interest in mind is key to winning a bidding war. Your job as a buyer is not to seal the deal, it’s your agent’s job and they need to know what your limit it is – and respect it. If your agent tries to up sell you on the price and encourage you to go beyond your budget, it’s time to find a new agent. - Keep your offer clean

Surprisingly, not everyone is after top dollar when it comes to selling their home. I’ve put in a lot successful offers that may not have been the highest, but they were the cleanest. A clean offer with pre-approved financing, especially in a multiple offer scenario, shows the seller that you are serious. Conditional sales and offers that are contingent on financing just don’t fly when there are other offers on the table.

New property listed in Downtown VE, Vancouver East

New property listed in Clayton, Cloverdale

New property listed in Westwood Plateau, Coquitlam

Vancouver house prices will require 100% of income by 2030!!!

A new report says that investors and homebuyers in Vancouver will need more than 100 per cent of their household income to afford a property in the city by 2030.

The report, Downsizing the Canadian Dream: Homeownership Realities for Millenials and Beyond, published by Vancouver City Savings Credit Union, said that more and more homebuyers and investors will have to revise their expectations.

Today, for example, the average property requires more than 48 per cent of the average household’s monthly income, but that will climb to 100 per cent by 2030, according to the report.

By 2030, average per cent of income required to maintain a mortgage in various communities will be unsustainable. For example:

- Vancouver will rise from 76 to 108 per cent.

- Metro Vancouver will rise from 49 to 66 per cent.

- Only Langley will remain affordable at 27 per cent

In the past 10 years, Vancouver condo prices have only increased 43 per cent, relative to the 126 per cent increase in the general market.

Currently, the communities where home values are still affordable to the average homebuyer or investor are Maple Ridge, New Westminster, Pitt Meadows, Port Coquitlam and Langley.

Yet, if trends are not reversed by a combination of public policy and changes in financial practices, even these communities will be unsustainable by 2030.

Source: REW

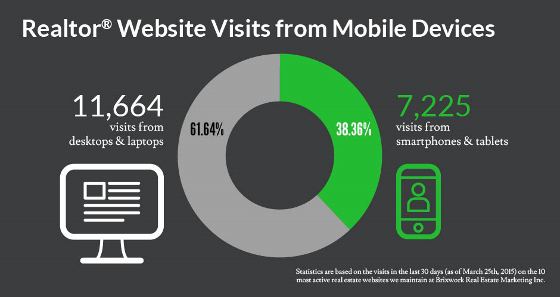

Is your website mobile responsive?

Why Your Realtor Website Must Be Mobile-Responsive

With a third of Realtor website views coming from mobile devices, responsive websites are a must-have, not a nice-to-have, says marketing guru Jeff Kee.

As of March 2015, approximately one-third of Realtor websites were viewed on mobile browsers rather than traditional desktop or laptop screens. Most people will google somebody’s name to find more information on that person before committing, and many others will stumble upon your website while they search for listings or agents on Google.

Mobile-Responsive Sites

Remember that time when you went to a site and you couldn’t find the email or phone number right away? Or the time when you had to pinch and zoom so much for one piece of information? And you hit the “back” button in frustration, or decided to check it out later at your office and totally forgot about it? When websites are mobile responsive, they are configured to morph to different sized screens for different mobile devices. Items will enlarge and reposition themselves for optimal viewing on the smaller screen. Some content can be hidden from mobile browsing views to optimize and speed up the user experience.

Customer Benefits of Responsive Real Estate Websites

- Full-width photos of homes: While many images are shown side-by-side on larger screens, this may be too small on an iPhone screen. Responsive sites will take side-by-side images and put them top-to-bottom for an easier viewing experience.

- Large, easy-to-read text: What used to be double or triple columned paragraphs becomes single column, therefore much larger. Users do not need to pinch-and-zoom to read small text.

- Easier to swipe through content: With a strictly vertical layout, people can easily swipe up & down to go through all your pages.

How Responsive Websites Rank Better on Google

- User bounces: When a user performs a search on a mobile browser and lands on a website that is not mobile-responsive (therefore hard to read), he/she may hit the back button right away. Google logs these bounces, and may consider your website less relevant to whatever search query that was used.

- Google plays favourites! Google has announced that they will be showing mobile-responsive results as a priority over those that are not. Google already shows “mobile-friendly” on search results as it is. Change in ranking based on this factor puts even greater importance on having a responsive website. You can lose a lot of visitors quickly if this happens.

- More traffic never hurts: While Google does not rank websites by popularity & traffic, having healthy traffic on your website as a result of becoming mobile responsive helps indirectly. You may get more shares/likes on Facebook and Twitter if more people stay on your site longer.

- Good website metrics: Having high number of visits & pageviews can also be a factor in winning that next big listing.

Responsive Mobile Websites Are Now A Must, Not An Option

There was a time when responsive websites were a new and fancy luxury item for businesses, when the first Blackberries were used by a few select people. Times have changed quickly, and it has now become a standard. Many users will find it frustrating to use a non-responsive website. Viewing habits have never changed this quickly in history of all media, and real estate agents need to adapt to it just as quickly.